Advanced automation for swift and accurate claims processing

Processing insurance claims can be a complex and time-consuming task for insurers. The challenges include

Large volume of claim forms and invoices

Extracting relevant data accurately

Ensuring the validity of the information provided

Manual processing can lead to errors, delays, and increased costs

Possibility of fraud, and associated revenue leakage

Hampering efficiency of claims settlement

Our applications revolutionize the insurance claims processing landscape by leveraging cutting-edge technology to automate and streamline the workflow.

0

X

faster claim

processing

processing

0

%

touchless claims

validation

validation

0

%

savings in manual processing costs

>

0

%

accuracy in data extraction from medical claim forms, invoices, receipts

Prohibitive costs of manual invoice processing

Highly variable invoice data and consequent data extraction errors

Complex and inefficient workflows that are constrained by repeated human intervention

Payment processing delays and strained vendor relationships

Sophisticated pretrained extraction models intuitively manage invoice data variations

Advanced data normalization, matching, and reconciliation capabilities

Auto-generate business rules using deep learning for faster value realization

High end-to-end process accuracy and straight-through processing

*for EDI invoices

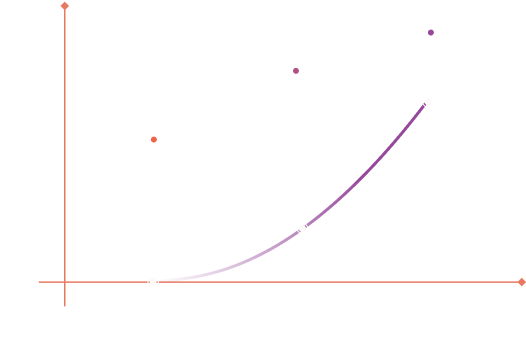

Heuristic business rules applied over 2+ years to improve matching and create a slow and long arc of value realization

Heuristic

AI

How we help simplify claims processing

- Pretrained deep learning models extract (up to 30 fields) and validate claims data from ACORD forms, medical invoices, and receipts. Customizable models can also be trained on your data sets

- Inbuilt exception management system for human-in-the-loop support for data correction and validation. Making sure you can access highly accurate data with confidence

- Advanced deep learning models to prevent fraud through invoice validations, duplicate checks, and policy validations

- Large language models to understand complex and verbose insurance contracts and validate claims against contract terms

- End-to-end claims automation with uncompromised data quality, data availability, and data-driven decisions

- Define field-level confidence scores for automated decision-making or involve human input when necessary

- Utilize exception management or integrated orchestration platform for business-specific routing rules, driving touchless processing and reserving team capacity for complex cases

- Make claim settlement decisions with the confidence of quality data, reduce cycle times, and dramatically improve customer experience

Helping customers with faster, risk-free processing

As a team that understands the challenges faced by organizations in their accounts payable operations, we offer advanced automation solutions to overcome these hurdles. Our AI-intuitive solutions provide a comprehensive answer to automating accounts payable processes.

As a team that understands the challenges faced by organizations in their accounts payable operations, we offer advanced automation solutions to overcome these hurdles. Our AI-intuitive solutions provide a comprehensive answer to automating accounts payable processes.

As a team that understands the challenges faced by organizations in their accounts payable operations, we offer advanced automation solutions to overcome these hurdles. Our AI-intuitive solutions provide a comprehensive answer to automating accounts payable processes.

As a team that understands the challenges faced by organizations in their accounts payable operations, we offer advanced automation solutions to overcome these hurdles. Our AI-intuitive solutions provide a comprehensive answer to automating accounts payable processes.

Explore industry trends with our curated resources

Discover how our automation can transform your claims-processing workflow

Our team of experts will guide you through our solutions’ features and benefits, showcasing remarkable efficiency, accuracy, and turnaround time improvements. Contact us now to schedule a demo and embark on the path to streamlined claims processing.